4th Quarter 2025 - Economic Update

- Jan 22

- 8 min read

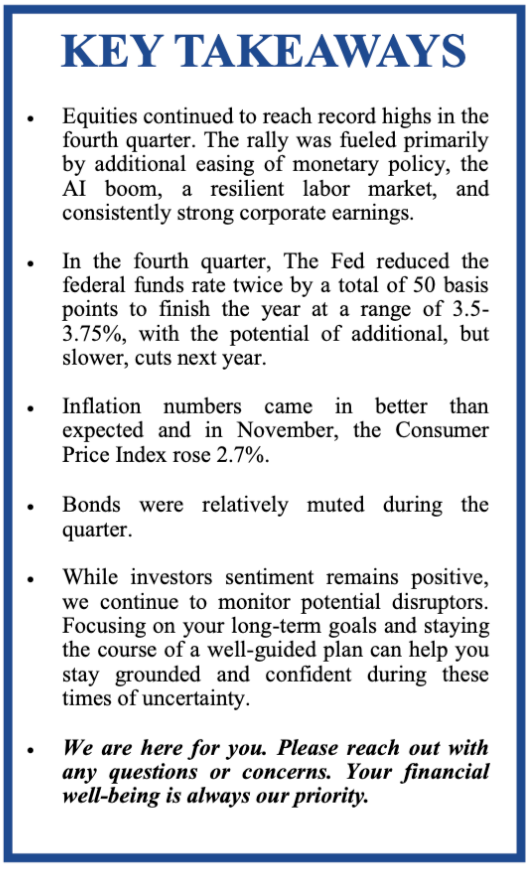

Equity markets closed out the fourth quarter of 2025 on a strong note, buoyed by an interest rate cut from the Federal Reserve in December. Delighting investors, 2025 marked the third consecutive year in which equities delivered double- digit returns. This extended bull market was powered largely by three federal rate cuts during the second half of the year, robust AI-driven technology earnings, and broadly positive investor sentiment.

During the fourth quarter, inflation continued to show incremental signs of easing, while economic growth remained resilient. This balance of moderating inflation and steady growth helped maintain investor confidence throughout the quarter.

The S&P 500 continued to experience new highs during the fourth quarter and closed at 6,845.50 for a gain of 2.4%, marking a roughly 16% gain for the year. The Dow Jones Industrial Average (DJIA) closed the quarter up 4.5%, ending at 48,063.29 and up approximately 13% for the year. (Source: Morningstar.com; cnbc.com)

Equity market conditions remain strong, and investor sentiment is largely bullish, although there are some underlying risks that warrant close attention. A decelerating labor market, historically high stock valuations, potential overextension in AI and technology stocks, and economic uncertainty, may weigh on investor enthusiasm and returns moving forward.

Many analysts feel that 2026 will be another good year for equity markets. Prominent Wall Street strategist Tom Lee expects 2026 to mirror much of 2025, with intermittent volatility followed by a potential year-end rally. Looking ahead, whether markets can achieve a fourth consecutive year of double-digit returns remains uncertain. (Source: marketwatch.com; 12/11/25)

Overall, the data continues to support a watchful but constructive long-term outlook for equities. As always, investors need to carefully choose portfolios that represent their unique objectives. Our role as financial professionals is to closely monitor market developments and ensure your portfolio remains aligned with your time horizon, risk tolerance, and financial objectives. We remain committed to keeping you informed, proactive, and well-positioned to navigate evolving market conditions with confidence.

Inflation & Interest Rates

Key Points:

Interest rates were lowered by 50 basis points in the fourth quarter, resting at 3.5 - 3.75%, after a total of three consecutive rate cuts since September. The Fed ended the year forecasting rate cuts in 2026, although at a slower pace than we experienced this quarter.

The core CPI, which does not include food and energy prices, was cooler than anticipated, increasing 2.6% over 12 months.

The Federal Open Market Committee (FOMC) lowered interest rates in October for the second time in a row. The committee had to operate and make decisions based on data that was behind schedule or unavailable, due to the government shutdown that ended November 12. With the information available the FOMC voted to lower interest rates and the December rate cut represented the third in a row, bringing the rate range to 3.5 – 3.75%. Equity markets reacted positively to this news, with major indexes reaching record highs. Looking ahead, the Fed anticipates there could be additional rate cuts. (Source: finance.yahoo.com, 9/18/25)

The most recent Bureau of Labor Statistics data for consumer prices came from November, when the annual rate rose by 2.7%, lower than expected. The core Consumer Price Index (less food and energy) rose 2.6%. Economists polled by the Dow Jones were surprised by this result, as they had anticipated the CPI to rise to 3.1%. (Source: cnbc.com; 12/18/25)

The December 18 news release by the Bureau of Labor Statistics showed year-over-year, food showed a gain of 2.6% while energy increased 4.2%. Shelter costs increased 3.0%.

Movements in interest and inflation rates are critical for investors' financial planning, and we will continue to closely monitor these key economic indicators.

The Bond Market and Treasury Yields

Key Points:

The fourth quarter of 2025 was relatively calm for the U.S. bond market.

During the fourth quarter, the U.S. Treasury market demonstrated cautious behavior relative to equities. As the quarter ended, the 10-year Treasury yielded 4.18%, the short-term 2-year Treasury was 3.47% and the 30-year Treasury closed at 4.84%. (Source: treasury.gov resource center)

For investors, bonds can still play a meaningful role in diversification, providing relative stability during periods of equity volatility.

Investor's Outlook

Key Points:

The bull market is expected by most strategists to extend into 2026.

Market volatility is likely to persist, making discipline and perspective essential.

Maintaining a long-term focus and avoiding short-term distractions has historically been one of the most reliable ways to achieve financial goals.

Experience imparts wisdom and broadens an investor’s perspectives. After the S&P 500 endured a drawdown of almost 20% in the first half of 2025, patient, non-emotional, well-disciplined investors were rewarded with new highs and robust returns in the second half of the year.

After a healthy fourth quarter for investors, we feel good about our portfolios. We still enter the new year with some lingering questions including, will 2026 be able to deliver another strong year of returns for the fourth consecutive year?

Analysts are optimistic about 2026, with a consensus that year-end returns will be positive, however, investors are aware that market pullbacks occur on average every year and a half, so statistically speaking, we must remain prepared for a potential pullback of 10% or more sometime in 2026. If 2025 taught us anything, it’s that during challenging times, it’s best to avoid emotional decisions. Although history is not a forecast of future outcomes, in 2025, the equity market rewarded investors who demonstrated patience and discipline during tough times.

As we begin 2026, there are numerous concerns that are reasons for investors to be cautious. While we are optimistic about the opportunity for another positive year in 2026, there are still many uncertainties to consider.

The second half of the year will bring the appointment of a new Fed chairman. Dennis Dick, chief market strategist at Stock Trader Network, shares that, “The next Fed Chair is probably going to be much more dovish than Jerome Powell, so I would imagine that we actually see in the second half of this year that interest rates go down substantially.”

The continuation of tariff talks and the possibility of a struggling economy could also cause issues in the first half of 2026. High valuations mean that any earnings disappointments could also disrupt the recent upward trajectory of equity markets. Additionally, geopolitics in several regions are at a challenging point and could lead to more uncertainty, which always seems to disrupt equity markets.

2026 is a midterm election year, and that historically has created increased uncertainty, as investors assess potential changes in Congressional control and their implications for taxes, spending, and regulation. While uncertainties remain, our focus continues to be on the factors most relevant to your personal financial situation. Many analysts still see the potential for the bull market to extend into 2026. Rather than viewing volatility solely as a risk, it can also be seen as a potential opportunity. Periods of market weakness can present openings to invest at more attractive prices, rebalance portfolios, or harvest losses to help offset capital gains. For now, we can appreciate the benefits of the current bull market while continuing to emphasize our guiding principle: proceed with caution.

A new year always brings the opportunity to review your situation. Here are some proactive planning reminders:

Consider IRA contributions for tax year 2025: Contributions can still be made until April 15, 2026.

Please notify us of any anticipated changes like life adjustments and important milestone “birthdays”: such as retirement, estate planning updates, and remind us of significant age-based milestones.

Evaluate your cash flow: Review your 2026 spending and savings plan to reflect upcoming goals and expected changes so you can maintain adequate cash flow.

Portfolio rebalancing: We try to use periodic rebalancing as a strategy for helping keep your portfolio aligned with your risk tolerance, time horizon, and goals. If you would like to review your financial situation before your next review, please contact our office.

Our commitment is to exceed your expectations in 2026 by delivering exceptional service, while maintaining consistent and meaningful communication. Our team is here to help you with every step of your journey toward your financial goals. Please feel free to reach out to us with any questions or concerns you may have. We greatly value the trust and confidence you place in our firm and look forward to continuing to serve you.

Disclosure:

Advisory Services offered through Materetsky Financial Group Inc., a Registered Investment Advisor. Securities offered by Registered Representatives through Private Client Services, Member FINRA/SIPC. Private Client Services and Materetsky Financial Group Inc. are unaffiliated entities. All insurance products are offered through unaffiliated insurance companies. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Materetsky Financial Group, Inc. [“Materetsky]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Materetsky. Materetsky is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Materetsky’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.materetsky.com. Please Remember: If you are a Materetsky client, please contact Materetsky, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian. Note: The views stated in this letter are not necessarily the opinion of broker/dealer, and should not be construed, directly or indirectly, as an offer to buy or sell any securities mentioned herein. Investors should be aware that there are risks inherent in all investments, such as fluctuations in investment principal. With any investment vehicle, past performance is not a guarantee of future results. Material discussed herewith is meant for general illustration and/or informational purposes only, please note that individual situations can vary. Therefore, the information should be relied upon when coordinated with individual professional advice. This material contains forward looking statements and projections. There are no guarantees that these results will be achieved. All indices referenced are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. The S&P 500 is an unmanaged index of 500 widely held stocks that is general considered representative of the U.S. Stock market. The modern design of the S&P 500 stock index was first launched in 1957. Performance prior to 1957 incorporates the performance of the predecessor index, the S&P 90. Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stocks of companies maintained and reviewed by the editors of the Wall Street Journal. Past performance is no guarantee of future results. CDs are FDIC Insured and offer a fixed rate of return if held to maturity. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed.There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices generally rise. There is no guarantee that a diversified portfolio will enhance overall returns out outperform a non-diversified portfolio. Diversification does not protect against market risk. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices generally rise. There is no guarantee that a diversified portfolio will enhance overall returns out outperform a non-diversified portfolio. Diversification does not protect against market risk.

Comments